This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Friday, August 5, 2022

Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn.

The July jobs report is expected to show another month of steady, but slowing, hiring in the U.S. economy.

But the Federal Reserve’s preferred measure of health for the labor market will not be getting an update when the BLS releases its latest monthly report on Friday morning.

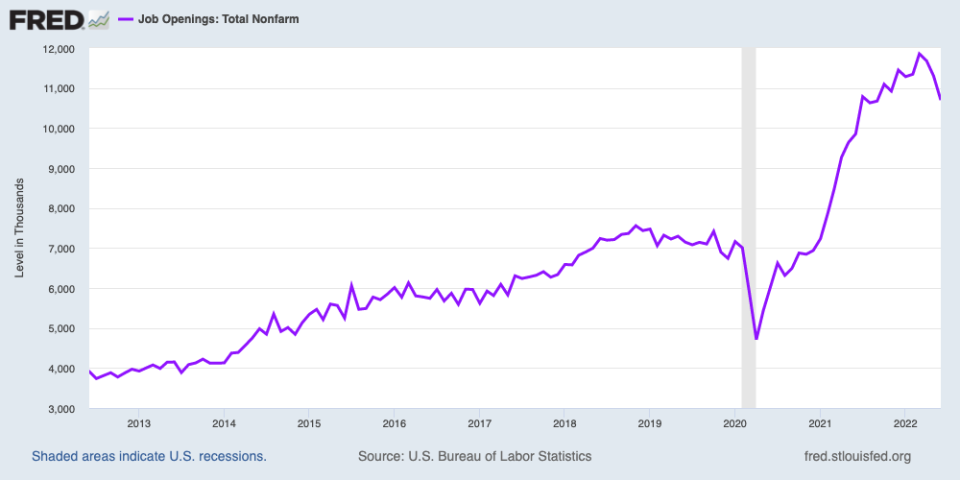

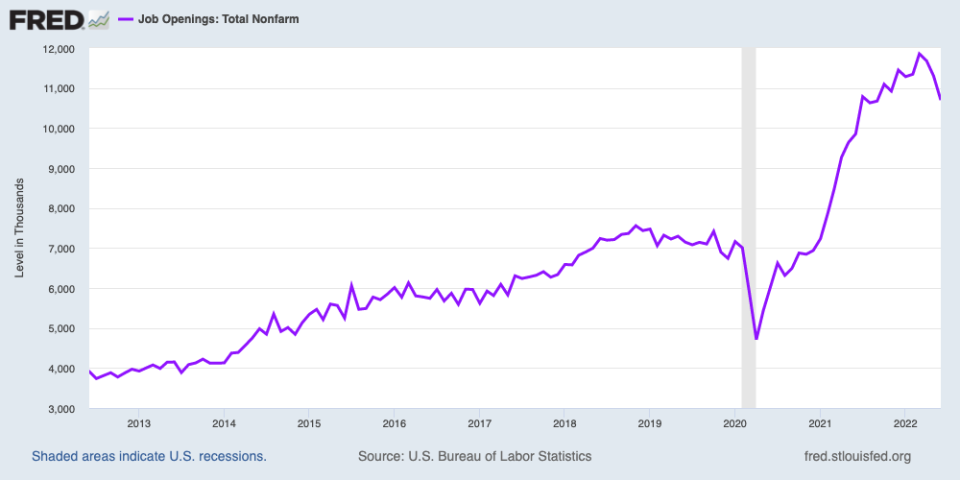

Earlier this week, we learned jobs openings are trending in the Fed’s preferred direction — which is lower.

In June, there were some 10.7 million jobs open in the U.S., down from 11.3 million the prior month and 11.9 million as of March, which marked a record high.

In recent months, Fed Chair Jay Powell has spoken at length about the number of open jobs and said in various ways there are simply too many vacancies in the U.S. labor market.

As far back as March of this year, Powell said elevated job openings indicated a labor market that was “tight to an unhealthy level.”

“If you were just moving down the number of job openings so that they were more like one to one,” Powell said, “you would have less upward pressure on wages. You would have a lot less of a labor shortage, which is going on across the economy.”

Speaking to reporters in late July, Powell said: “There’s a feeling that the labor market is moving back into balance. If you look at job openings or quits, you see them moving sideways or perhaps a little bit down. But it’s only the beginning of an adjustment.”

And whether this “adjustment” will indeed bring down job openings without spiking unemployment has also become the subject of fierce debate in the economics community.

Fed economists Andrew Figura and Chris Waller argued last month the number of open jobs can be brought down without causing unemployment to spike.

Economists Olivier Blanchard, Alex Domash, and Larry Summers wrote in response that this analysis “contains misleading conclusions, errors, and factual mistakes,” arguing that “vacancies are very unlikely to normalize without a major increase in unemployment.”

As of June, the latest month for which both unemployment and job openings data are available, the unemployment rate stood at 3.6%. Wall Street expects the unemployment rate held steady in July.

Since Powell’s March comments, of course, things have begun to change markedly on the labor front.

In the tech sector, job cuts have become an unfortunate reality for many companies that were high-flyers during the pandemic, with Robinhood’s (HOOD) announcement this week the latest example. Meanwhile, weekly filings for unemployment insurance — the labor market’s best real-time gauge — rose again last week and are near 8-month highs.

“The jobs market is not impervious to the slowdown in spending and investment already underway,” Sarah House, an economist with Wells Fargo, wrote in a note published Thursday. “Cracks have begun to show.”

Economists expect the U.S. economy created 250,000 jobs in July, data that would be consistent with a “growing but slowing” view of the economy seen in data across industries.

And in Powell’s view, slowing growth isn’t just table stakes — it’s the Fed’s desired outcome.

“We think it’s necessary to have growth slow down,” Powell said last week. “We actually think we need a period of growth below potential, in order to create some slack so that the supply side can catch up. We also think that there will be, in all likelihood, some softening in labor market conditions. And those are things that we expect…to get inflation back down on the path to 2 percent.”

What to Watch Today

Economic calendar

-

8:30 a.m. ET: Change in Nonfarm Payrolls, July (250,000 expected, 372,000 during prior month)

-

8:30 a.m. ET: Change in Private Payrolls, July (230,000 expected, 381,000 during prior month)

-

8:30 a.m. ET: Change in Manufacturing Payrolls, July (20,000 expected, 29,000 during prior month)

-

8:30 a.m. ET: Unemployment Rate, July (3.6% expected, 3.6% during prior month)

-

8:30 a.m. ET: Average Hourly Earnings, month-over-month, July (0.3% expected, 0.3% during prior month)

-

8:30 a.m. ET: Average Hourly Earnings, year-over-year, July (4.9% expected, 5.1% prior month)

-

8:30 a.m. ET: Average Weekly Hours All Employees, July (34.5 expected, 34.5 during prior month)

-

8:30 a.m. ET: Labor Force Participation Rate, July (62.2% expected, 62.2% during prior month)

-

8:30 a.m. ET: Underemployment Rate, July (6.7% prior month)

-

3:00 p.m. ET: Consumer Credit, June ($25 billion expected, $22.347 billion during prior month)

Earnings

-

Atlas Air Worldwid (AAWW), Brookfield Renewable Partners (BEP), Canopy Growth (CGC), Gogo (GOGO) Goodyear Tire (GT), Western Digital (WDC), WideOpenWest (WOW)

Yahoo Finance Highlights

—

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube