Australia has been urged to cut gas exports in a move that would exacerbate the global energy crisis.

The Government is weighing up the move after the Australian Competition and Consumer Commission (ACCC) warned the country – which is one of the world’s biggest suppliers of liquefied natural gas – could face shortages and soaring prices next year.

The watchdog said extra gas was needed to offset declining output at offshore fields that have long supplied the east coast, which is home to nearly 90pc of Australia’s population.

Ministers will consult with LNG exports and the country’s trading partners before making a decision in October.

While the UK didn’t import any gas from Australia last year, any cuts to supply would have a knock-on effect through the market.

The move would likely add to supply troubles and soaring prices at a time when consumers are already grappling with the fallout from Russia’s war in Ukraine and lower supplies from Moscow.

02:08 PM

Textbooks to be turned into NFTs as publisher eyes secondhand market

School and university textbooks are to be turned into non-fungible tokens (NFTs) under plans from FTSE 100 education publisher Pearson to get a cut of the lucrative secondhand book market.

Ben Woods reports:

Chief executive Andy Bird said blockchain technology would allow Pearson to place unique trackable codes in its digital books, letting the company take a slice of any resale by a student or college.

Mr Bird said: “In the analogue world, a Pearson textbook was re-sold up to seven times. We would only participate in the first sale, and it created what is known as the secondary market.

“The move to digital helps us diminish the secondary market, and technology like blockchain and NFTs allows us to participate in every sale of that particular item as it goes through its life.”

NFTs are an offshoot of cryptocurrencies that allow digital items to be given a unique code. The idea is to prevent duplication and track ownership.

NFTs have mainly been applied in the art world and exploded in popularity during the pandemic. However, the trade in NFTs has fallen sharply in recent months. According to a report by Chainalysis, a crypto research firm, NFTs sales totalled just over $1bn in June, having peaked at $12.6bn in January.

01:41 PM

Octopus asks for £1bn to take over Bulb customers

Octopus Energy is said to be asking the Government for £1bn to cover costs if it takes on customers from collapsed energy supplier Bulb.

The Government has been seeking a buyer for Bulb since it went bust last year, leaving about 1.6m customers adrift.

As part of a potential deal, Octopus is asking for support with the hedging costs of power and natural gas, Bloomberg reports.

About £2.2bn in taxpayer money has already been pumped into Bulb to keep it afloat, with Teneo running the administration. A deal is expected in weeks.

01:19 PM

The energy vampires sucking Britain’s grid dry

A shortage of houses in London and the south east has long been one of the most prolific problems facing the Government, writes Gareth Corfield.

Yet desperately needed fresh supply is unlikely to materialise soon in west London, after developers were last week told they may be prevented from starting new projects in the area until 2035, because the electricity grid has run out of capacity.

But it isn’t just tightening energy supplies amid the war in Ukraine that is behind the de facto ban – surging demand for data centres is sucking Britain’s power grid dry.

These warehouse-sized buildings full of computer servers absorb so much electricity that the Greater London Authority (GLA) told housebuilders it may be more than a decade until new developments in Hillingdon, Ealing and Hounslow can be sustained by the grid.

Much of the problem boils down to the economic success of the M4’s “Silicon Corridor”. As technology and finance companies compete for office space near the data centres that power their businesses, demand inevitably begets greater supply.

12:06 PM

US futures fall as recession fears rattle markets

US futures fell alongside oil this morning as investors weigh inflation risks against the prospect of further interest rate rises.

Oil dropped after poor Chinese economic data added to concerns that a global slowdown may sap demand. However, traders are betting that the Federal Reserve may slow down its pay of interest rate rises after data showed the US tumbled into recession.

Futures tracking the S&P 500 and Nasdaq fell 0.2pc and 0.3pc respectively. The Dow Jones was little changed.

12:03 PM

Lisa Nandy attends BT picket line

Lisa Nandy appeared on a picket line with striking BT workers this morning in a move that’s likely to test Keir Starmer’s authority.

Ms Nandy, shadow levelling up secretary, was photographed speaking to BT and Openreach employees taking party in a strike in Wigan.

Members of the Communication Workers Union are staging a 24-hour walkout in protest against a below-inflation pay rise.

Ms Nandy’s attendance will add to the dilemma facing Starmer, who’s torn between supporting Labour’s traditional backers in the unions while avoiding stoking worker unrest.

Last week he came under fire from unions and left-wing MPs for sacking shadow minister Sam Tarry after he joined a picket line with striking rail workers.

11:50 AM

Hinkley B’s second reactor switched off for decommissioning

The second reactor at Britain’s Hinkley Point B nuclear power station has been shut down for decommissioning, owner EDF has said.

The 1 gigawatt plant in Somerset began producing electricity for the UK grid in 1976, but has now reached the end of its life.

The Hinkley Point B-7 reactor will soon start the defuelling process, which involves removing the nuclear fuel from the reactors and could take a few years, according to EDF. The site’s other reactor, B-8, was shut down last month.

The closure has been long planned, but comes at a time of heightened concern over energy security as Russia restricts flows of gas to Europe.

EDF is currently building a new plant – Hinkley Point C. It is expected to start operations in 2027, a decade later than originally planned, and cost an estimated £25bn to £26bn.

Read more on this story: Hinkley Point B closure adds to strain on Britain’s power supplies

11:34 AM

Crop prices fall as first grain ship leaves Ukraine

Wheat and corn futures dipped this morning as a ship carrying grain left Ukraine for the first time since Russia’s invasion.

The Razoni, a cargo ship loaded with 26,527 tonnes of corn, left for Lebanon this morning, according to the UN. Ukraine has said there are 16 other ships in the Odesa region waiting to sail.

Ukraine is usually one of the world’s biggest suppliers of wheat, corn and vegetable oil, but its shipments have been stranded since Russia blockaded ports.

Still, there are many obstacles in place before shipments can continue as normal, including securing crew and insurance for ships.

Corn fell 1.3pc to $6.12 a bushel – its first decline in six days. Wheat dropped for a second day to $8.04 a bushel.

11:14 AM

British motorists second only to Finland in high fuel prices

ICYMI – British motorists are paying higher petrol prices than anywhere else in Europe except Finland, the RAC claimed as it attacked the Government’s failure to reduce fuel duties.

Tom Rees has more:

Prices are at least 20p per litre cheaper in the eurozone’s big four economies of Germany, France, Italy and Spain, while many countries made much bigger cuts to fuel taxes, according to the motoring group.

Drivers were handed a 5p per litre cut to fuel duty by Rishi Sunak when he was chancellor, a £2.4bn giveaway. But it is dwarfed by the action taken by many European countries, including Germany, Italy and Ireland.

The RAC found that the average petrol price in the UK is 186p per litre, higher than all 27 EU countries bar 190p in Finland. It also revealed that the UK ranks 12th out of the 13 countries that cut fuel taxes in response to rocketing oil prices. Only Luxembourg opted for a smaller petrol tax cut but overall fuel prices in the minnow state are already much lower than the UK’s.

10:57 AM

City watchdog draws up tighter rules over misleading ads

The City watchdog has finalised stronger rules to help tackle misleading adverts that encourage investment in high-risk products.

Firms marketing some types of high-risk investments will need to conduct better checks to ensure consumers and their investments are well-matched, the Financial Conduct Authority said.

Companies will also need to use clearer and more prominent risk warnings and certain incentives to invest – such as ‘refer a friend’ bonuses – are now banned.

The new rules won’t apply to crypto asset promotions as the FCA is still waiting for confirmation of how crypto marketing will be brought under its remit.

10:46 AM

Heineken sales jump despite inflation threat

Heineken has reported better-than-expected sales as punters kept drinking its beer, though it struck a cautious tone on the outlook amid sky-high inflation.

The Dutch brewer said volumes rose 7.6pc in the first half of the year – beating expectations.

The figures show that customers have so far tolerated higher prices. Heineken said it raised prices by an average of 8.9pc in the first half and warned more hikes may come in the remainder of this year.

Shares in Heineken fell as much as 3.5pc in early trading.

10:33 AM

Pound edges higher as focus turns to BoE

Sterling has edged higher against the dollar as traders turn their attention to the Bank of England interest rate decision later this week.

Officials are expected to push through the biggest interest rate rise in 27 years and unveil the Bank’s strategy for selling off part of its bond portfolio.

“Expect a bit of a wait-and-see approach in GBP price action heading into Thursday’s BoE rate announcement,” said analysts at ING.

The pound rose 0.3pc against the dollar to $1.2207. Against the euro it was little changed at 83.92p.

10:21 AM

HSBC to hand some staff £1,500 cost-of-living bonus

HSBC is said to be paying some of its staff a £1,500 one-off bonus to help deal with the cost-of-living crisis.

The bank will hand the pay bump to selected workers in Britain, according to a memo seen by Reuters.

It follows similar moves by rivals including TSB and Co-op Bank, but would make HSBC the largest lender to offer pay boosts to staff as inflation continues to soar.

It comes after HSBC earlier said it will reinstate its dividend as it pushes back against calls for a break-up from biggest investor Ping An.

10:07 AM

Google boss tells staff they are not productive enough

The boss of Google has warned staff they are not productive enough and must find ways to reduce distractions at work, writes Gareth Corfield.

Announcing a new initiative to boost output called Simplicity Sprint, Chief Executive Sundar Pinchai said: “There are real concerns that our productivity as a whole is not where it needs to be for the headcount we have.”

Mr Pinchai also told his 170,000 employees he would “love to get all your help”, at the internal meeting first reported by CNBC.

He added: “We should think about how we can minimize distractions and really raise the bar on both product excellence and productivity.”

Google staff will be asked to put forward ideas for speeding up product development, as part of a scheme to “get better results faster,” Mr Pichai said.

Google has grown 10pc since the July 27 announcement of its financial results, trading at $115.70 in pre-market trading at the time of writing. This is a 13pc drop compared with last year as its share price tracks the broader rout in tech stocks.

09:54 AM

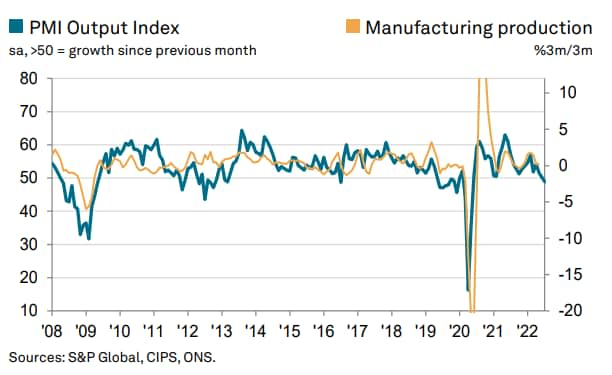

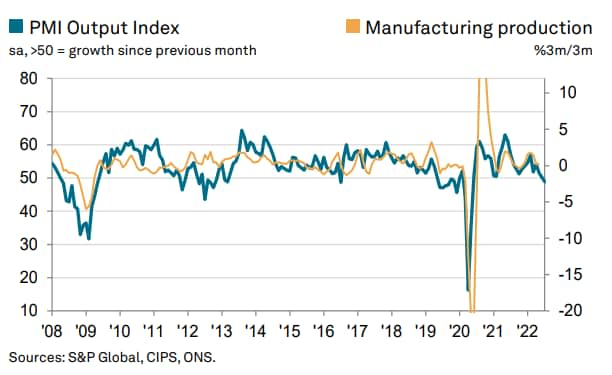

Reaction: Manufacturers show early symptoms of decline

Fhaheen Khan, senior economist at manufacturing group Make UK, warns the sector is facing more troubling times ahead.

Manufacturing activity is revealing the early symptoms of a decline as the backlog of orders clear, and businesses fail to secure new work.

Rampant inflation has been the main contributor to this as passing costs down the chain leads to more consumers reducing their appetite and willingness to spend.

However, manufacturers remain optimistic and continue to hire at speed, filling vacancies where possible. But the fact remains the economy is slowing and businesses will need to be wary of a far more difficult period to come.

09:43 AM

UK factory output and orders shrink at fastest pace since 2020

There’s more economic woe this morning as new data showed UK factory output and new orders declined last month at the sharpest rate since early in the pandemic.

The S&P Global PMI fell last month to 52.1 from 52.8 in June, revised down slightly from a preliminary reading of 52.2. The fall would have been greater but for an upward revision to the survey’s jobs index.

The survey’s gauges of output and new orders fell sharply and reached their lowest levels since May 2020, when the economy was hammered by the first Covid lockdown.

It’s the latest sign that rising costs and slowing demand could push Britain into recession.

Rob Dobson, Director at S&P Global Market Intelligence, said:

The UK manufacturing sector shifted into reverse gear at the start of the third quarter.

Output contracted for the first time since May 2020, as new order intakes suffered the first back-to-back monthly decreases for two years.

Rising market uncertainty, the cost of living crisis, war in Ukraine, ongoing supply issues and inflationary pressures are all hitting demand for goods at the same time, while lingering post-Brexit issues and the darkening global economic backdrop are hampering exports.

09:35 AM

Quilter shares surge on NatWest takeover report

Quilter is flying high at the top of the mid-cap index this morning following a report that NatWest is considering a bid for the wealth management firm.

Private equity firms including CVC Capital Partners, Bain Capital and BC Partners have also shown interest in the company in recent weeks, the Daily Mail reports.

Quilter jumped as much as 17pc and is now trading around 14pc higher.

09:18 AM

EU manufacturing slump deepens as recession fears grow

Manufacturing activity across the eurozone fell into contraction last month, fuelling concerns that the bloc could tumble into recession.

S&P Global’s PMI fell to 49.8 in July from 52.1 the previous month – just ahead of a preliminary reading of 49.6 but its first time in contraction since June 2020.

An index measuring output sank to a more than two-year low of 46.3. In June it was 49.3.

The decline came as factories were forced to stockpile unsold goods due to weak demand in a worrying sign of a slowdown in the economy.

Chris Williamson, chief business economist at S&P Global, said:

Eurozone manufacturing is sinking into an increasingly steep downturn, adding to the region’s recession risks.

New orders are already falling at a pace which, excluding pandemic lockdown months, is the sharpest since the debt crisis in 2012, with worse likely to come.

Lower than anticipated sales, reflected in accelerating rates of decline of new orders and exports, have led to the largest rise in unsold stocks of finished goods ever recorded by the survey.

09:06 AM

Gas prices surge as Putin’s supply cuts weigh

Gas prices are back on the rise this morning as Putin’s cuts to supplies sparks fears of shortages this winter and sends shockwaves through the economy.

Benchmark prices rose as much as 6.5pc after posting their biggest weekly gain in more than a month. They’re now more than four times higher than a year ago.

Russia yesterday halted supplies to Latvia, saying the Baltic nation had “violated the conditions” of its purchases. It adds to jitters that Putin could turn off the taps to Europe completely.

The EU has told member states to curb gas use and is looking to source more supplies from elsewhere. Still, the bloc is struggling to refill storage sites in time for winter, when demand will peak.

08:53 AM

Pearson gains on cost-cutting plans

It’s a strong start to trading for Pearson, which has beaten expectations for the half term and reassured investors with its cost-cutting plans.

Revenue and underlying growth were both ahead of forecasts for the first half. Estimates for this year were unchanged, but the education group lifted its expectations for 2023.

It came as Pearson identified £100m of cost savings for 2023, which analysts at Citi said would put any lingering concerns over the outlook to rest.

Shares rose 6.5pc.

08:49 AM

FTSE risers and fallers

The FTSE 100 has start the week in positive territory, with markets looking ahead to the Bank of England interest rate decision later this week.

The blue-chip index climbed as much as 1.1pc before paring gains to around 0.4pc.

HSBC was the biggest winner, gaining 6.6pc after announcing plans to resume its dividend as it pushed back against calls for a break-up by investor Ping An.

Pearson was also up around 6p after reiterating its full-year profit outlook and saying its new integrated structure under boss Andy Bird was helping to save costs and grow the top line.

The domestically-focused FTSE 250 gained 0.2pc after hitting a seven-week high last week. Quilter topped the index, surging 17pc on reports NatWest is considering a bid for the fund manager.

08:24 AM

Christian Candy sells ‘Candyland’ estate for £125m

Christian Candy is said to have sold his luxury estate just west of London for about £125m in one of the biggest property deals this year.

The property developer bought Cheval Manor in 2015 for £29m, filings show. He then bought up neighbouring plots to create a sprawling collection of buildings connected by tunnels that’s been dubbed ‘Candyland’.

It boasts a 25m underground swimming pool, gym, massage and steam rooms, as well as a basement that can house a collection of almost 60 cars.

He’s now sold the estate to a buyer from the Middle East, the Financial Times reports.

Candy rose to fame alongside his brother Nick after developing the One Hyde Park building in Knightsbridge.

08:09 AM

Oil declines as Chinese slowdown sparks demand fears

Oil has started the week’s trading on the back foot after weak economic data from China added to concerns that a global economic slowdown may hurt demand.

Benchmark Brent crude slipped below $104 a barrel, while West Texas Intermediate traded under $98 after sinking almost 7pc in July. That was its first back-to-back monthly loss since late 2020.

The latest decline follows an unexpected fall in China’s manufacturing PMI, which will reignite concerns about lower demand for commodities.

That follows data last week showing the US plunged into recession, while the Federal Reserve raised interest rates aggressively again.

08:01 AM

FTSE 100 jumps at the open

It’s a strong start to the week for the FTSE 100, which has pushed sharply higher at the opening bell.

The blue-chip index jumped more than 1pc to 7,423 points.

07:53 AM

JD Sports loses £50m as it sells off Footasylum

JD Sports has lost around £50m on its disastrous takeover of Footasylum after the competition watchdog forced it to unwind the deal.

The sportswear retail paid almost £90m for its smaller rival in 2019, but the Competition and Markets Authority blocked the merger amid concerns about competition in the footwear market.

Long-time boss Peter Cowgill then resigned after he was caught sharing commercially sensitive information with the boss of Footasylum during a clandestine meeting in a car park. The company was also fined £4.3m for the incident.

JD Sports has now signed a deal to sell off Footasylum to private equity firm Aurelius Group for just £37.5m. JD also owns Tessuti and Go Outdoors.

07:40 AM

HSBC pushes back over break-up

Here’s more from HSBC’s chief financial officer Ewen Stevenson on break-up talks with Ping An.

He told Bloomberg:

We are definitely talking to Ping An and continue to talk with them.

We we look at all of the various structural alternatives, a combination of upfront costs, a lot of complexity, [it] would take up three to give years to implement any form of material structural alternative.

Based on what we can see today, it’s very hard to find any value case that we can put in front of shareholders.

07:36 AM

HSBC vows to restart dividend

Good morning.

HSBC has vowed to resume its quarterly dividend as it pushes back against calls from its biggest shareholder for a break-up of the bank.

The London-based lender said it’s held talks with Ping An, the Chinese insurance giant that’s pushing for HSBC to spin off its Asian operations and list them in Asia.

However, it insisted that such a move would have little value for shareholders.

Meanwhile, HSBC raised its profitability target and said it will start paying a quarterly dividend from the start of 2023 as it looks to woo investors.

5 things to start your day

1) British motorists second only to Finland in high fuel prices Prices are at least 20p per litre cheaper in the eurozone’s big four economies of Germany, France, Italy and Spain.

2) Zelensky warns of catastrophic Ukraine harvest as world faces food crisis The blockade of Ukrainian ports by Vladimir Putin’s war machine has cut off the wheat, corn and sunflower seed giant and hampered production.

3) Markets bet interest rates will double by end of 2022 Officials on Threadneedle Street are expected to vote for a rare 0.5 percentage point increase to interest rates on Thursday.

4) Murdoch battle for viewers with GB News triggers bidding war GB News and TalkTV are vying to secure a channel slot on Virgin Media that would aid their struggle to attract viewers.

5) Iceland’s freezers leave supermarket with soaring energy bills Sustained increases in energy costs throughout the course of this year will have a “more permanent impact” on profits at the frozen food chain.

What happened overnight

Hong Kong stocks opened with more losses this morning. The Hang Seng Index dropped 0.6pc.

The Shanghai Composite Index dipped 0.2pc, while the Shenzhen Composite Index on China’s second exchange eased 0.1pc.

Tokyo stocks edged up in early trade, with the benchmark Nikkei 225 index adding 0.05pc at the open, and the broader Topix index climbing 0.1pc.

Coming up today

Corporate: Ascential, HSBC, Pearson, RHI Magnesita NV, Spectris, XP Power (interim results); Cranswick (trading update)

Economics:Manufacturing PMI (UK, US, EU), unemployment rate (EU), retail sales (Ger)