Shopify (SHOP 0.68%) and The Trade Desk (TTD 0.22%) are excellent growth stocks investors can buy and hold for the next decade. Each delivers robust revenue expansion as they ride powerful secular long-run tailwinds.

Buying and holding these stocks for a decade will give you a full measure of the power of compounding. Let’s consider how each has grown over previous years to get an idea of their potential over the next 10 years.

1. Shopify’s revenue is snowballing

Shopify has been riding the long-running tailwind of consumers spending more money online. E-commerce spending in the U.S. as a percentage overall has grown from 4.2% in the first quarter of 2010 to 12.9% by the fourth quarter of 2021. Shopify benefited from that trend as an enabler of e-commerce, helping merchants establish their websites and accept payments online.

Indeed, Shopify’s revenue exploded from $24 million in 2012 to $4.6 billion in 2021. The rapid revenue growth has also fueled the company’s gross profit from $19 million to $2.5 billion in that same time period.

Despite that dramatic historical growth, Shopify has a long runway ahead. E-commerce sales as a percentage of overall are projected to rise to 22% by 2025. Shopify can ride the back of that tailwind for continued revenue and gross profit expansion.

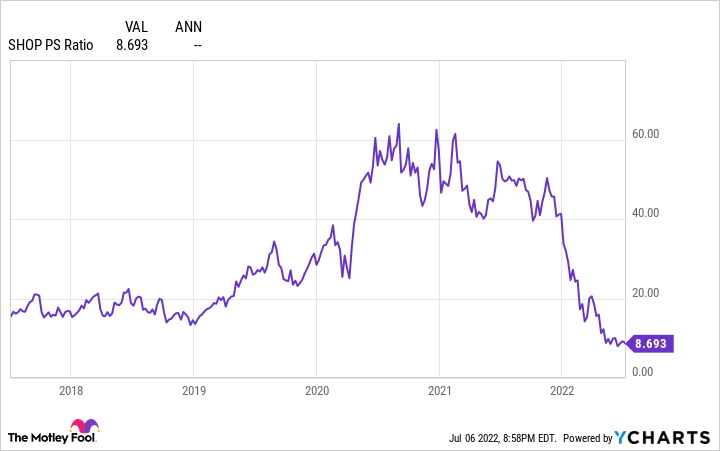

SHOP PS Ratio data by YCharts

Fortunately for potential investors, Shopify’s stock is arguably as cheap as it’s been in the past five years, trading at a price-to-sales ratio of 8.2. Investors who buy and hold Shopify for 10 years will likely experience considerable increases in the share price in that time.

2. The Trade Desk is serving a massive total addressable market

Like Shopify, The Trade Desk is benefiting from a powerful secular tailwind. The Trade Desk helps businesses purchase digital advertising through its automated platform. Fortunately for The Trade Desk, advertisers have been increasingly shifting their spending to digital.

Online advertising offers advantages over offline methods. Spending money on billboards, radio, or newspaper placements makes performance measurement difficult. How many people saw your advertisement, and how much did it boost sales? The complexity in answering those questions could mitigate the benefits of the aforementioned ad verticals.

Compare that to digital spending on social media or connected TV, where you can more accurately determine how many people saw your advertisement, clicked your banner, and purchased a product from your website. That can help explain why the percentage of spending on digital advertising increased to 64.4% in 2021 from 52.1% in 2019 — a meaningful increase when you consider that marketers spent $763 billion on ads in 2021.

The Trade Desk capitalized on this trend, as revenue has multiplied from $45 million in 2014 to $1.2 billion in 2021. Likewise, that boosted its gross profit from $32 million to $975 million in that time. Those advantages over offline advertising methods should continue, meaning The Trade Desk could find itself growing for several more years.

TTD PS Ratio data by YCharts

While The Trade Desk is not trading at its lowest levels in the last five years like Shopify, it is still considerably off its highs. The Trade Desk is another stock that is likely to grow your wealth if you buy and hold it over the next 10 years.

Parkev Tatevosian has positions in Shopify and The Trade Desk. The Motley Fool has positions in and recommends Shopify and The Trade Desk. The Motley Fool recommends the following options: long January 2023 $1,140 calls on Shopify and short January 2023 $1,160 calls on Shopify. The Motley Fool has a disclosure policy.